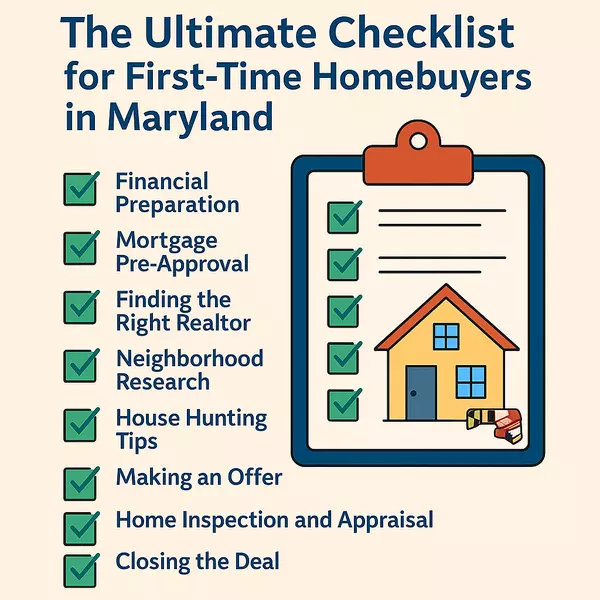

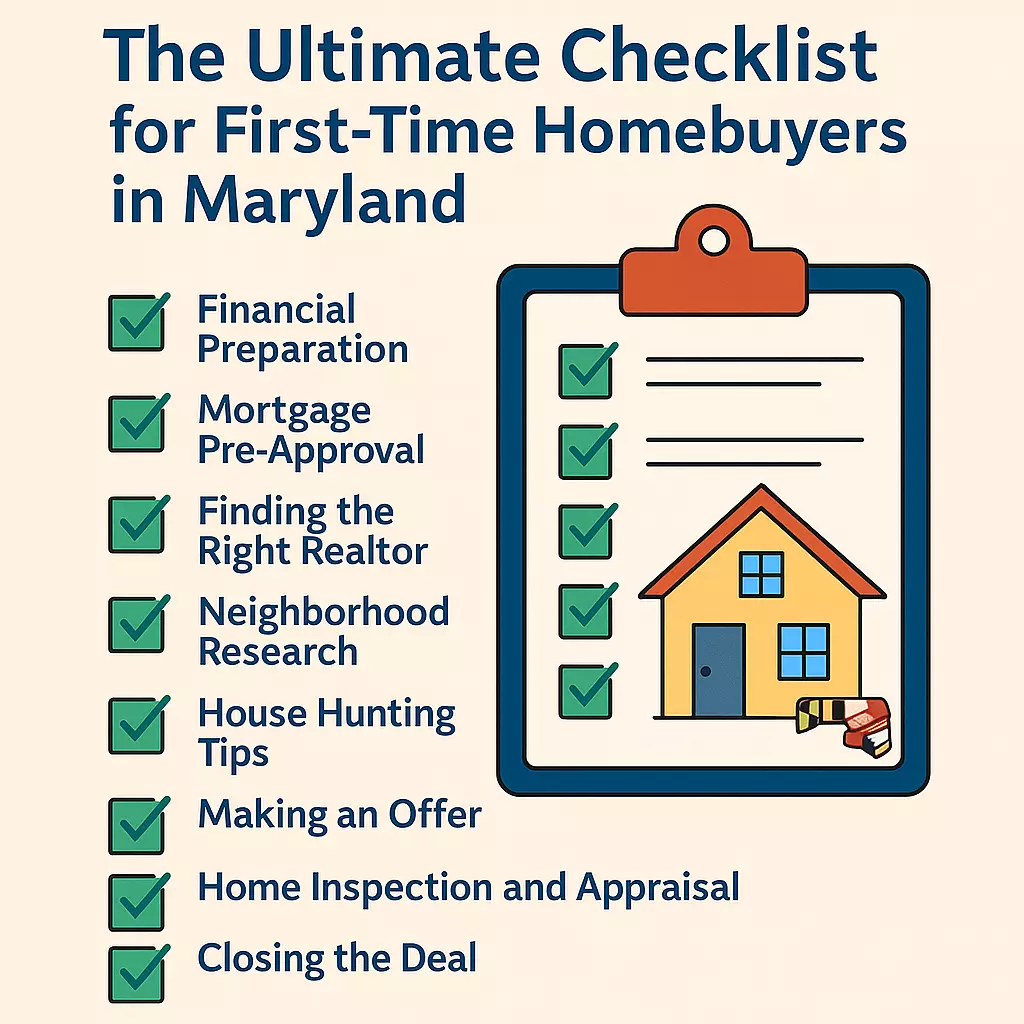

The Ultimate Checklist for First-Time Homebuyers in Maryland

Introduction

Buying your first home is a major milestone, especially in the vibrant and diverse state of Maryland. Whether you're looking to settle in bustling cities like Hyattsville, Silver Spring, Rockville, or Bethesda, having a clear plan can make the homebuying journey smoother and more rewarding. As a first-time homebuyer, being prepared can help you secure the best deal and avoid common pitfalls. In this guide, we’ll walk you through the essential steps to becoming a proud homeowner.

Step 1: Financial Preparation

Before you start looking at listings, it’s crucial to get your finances in order. Here are a few steps to set you on the right path:

-

Create a Budget: Understand your monthly expenses and determine how much you can realistically afford. Factor in mortgage payments, property taxes, insurance, and maintenance.

-

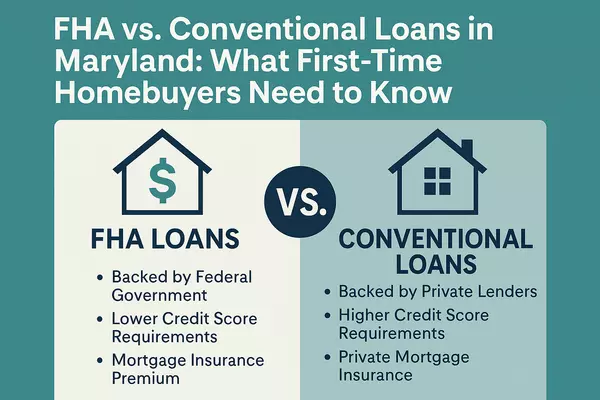

Save for a Down Payment: In Maryland, down payment requirements can vary. Aim for at least 20% of the home price to avoid private mortgage insurance (PMI).

-

Check Your Credit Score: A higher score means better loan options. Work on paying down debts and correcting any errors on your credit report.

Step 2: Mortgage Pre-Approval

Getting pre-approved for a mortgage demonstrates to sellers that you are a serious and qualified buyer. Work with a reputable lender to understand your financing options. Documents you may need include:

-

Recent pay stubs

-

Tax returns from the past two years

-

Bank statements

-

Proof of down payment funds

Step 3: Finding the Right Realtor

Partnering with a knowledgeable realtor in Maryland can make all the difference. An experienced local agent will guide you through the market trends in cities like Hyattsville and Bethesda and help you find properties that fit your budget and lifestyle.

Step 4: Neighborhood Research

Choosing the right neighborhood is essential. Consider factors like school districts, commute times, safety, and nearby amenities. Popular areas for first-time buyers include:

-

Hyattsville: Known for its arts district and proximity to Washington, D.C.

-

Silver Spring: A bustling urban center with cultural diversity.

-

Rockville: Family-friendly with excellent schools.

-

Bethesda: Upscale living with top-notch dining and shopping.

Step 5: House Hunting Tips

Attend open houses and schedule viewings. Pay attention to the property’s condition, neighborhood vibes, and potential renovations. Make a checklist of your must-haves versus nice-to-haves.

Step 6: Making an Offer

Your realtor will help craft a competitive offer, balancing your budget with current market conditions. Be prepared to include contingencies, such as financing and inspection clauses.

Step 7: Home Inspection and Appraisal

Never skip the inspection. It’s your chance to uncover any issues that might affect the home’s value or your decision to buy. The appraisal ensures that the lender is not over-financing the property.

Step 8: Closing the Deal

Review all documents carefully, including the closing disclosure and mortgage agreement. On closing day, sign the necessary paperwork, transfer the funds, and collect your keys!

Conclusion

Buying your first home in Maryland is an exciting journey. By following this checklist, you can make informed decisions and avoid common challenges. Ready to take the next step? Contact a reliable realtor in Maryland today to guide you through the process and find your dream home.

Categories

Recent Posts