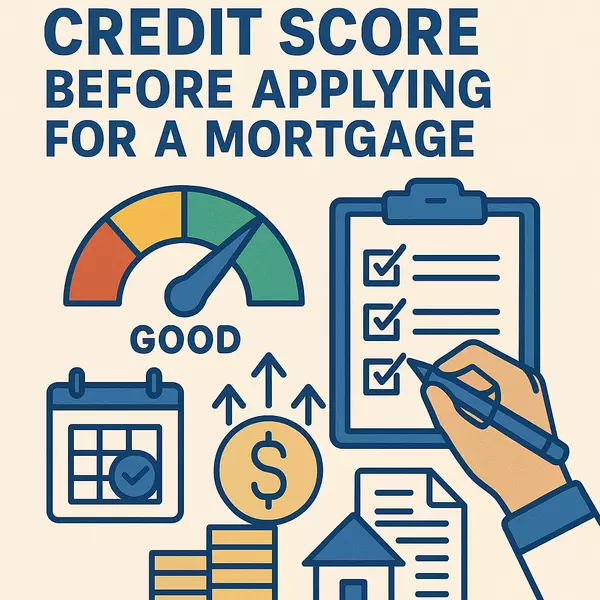

How to Improve Your Credit Score Before Applying for a Mortgage

If you’re dreaming of buying a home in Maryland—whether in Hyattsville, Bowie, Lanham, or Germantown—your credit score plays a huge role in your mortgage approval and the interest rate you’ll get. As a local Maryland realtor, I work with many first-time homebuyers who ask, “How can I improve my credit before applying for a loan?”

Here’s a clear, step-by-step guide to help you boost your score and position yourself for success.

🔍 Why Your Credit Score Matters

Lenders use your credit score to determine:

✅ Whether you qualify for a mortgage

✅ What interest rate you’ll pay

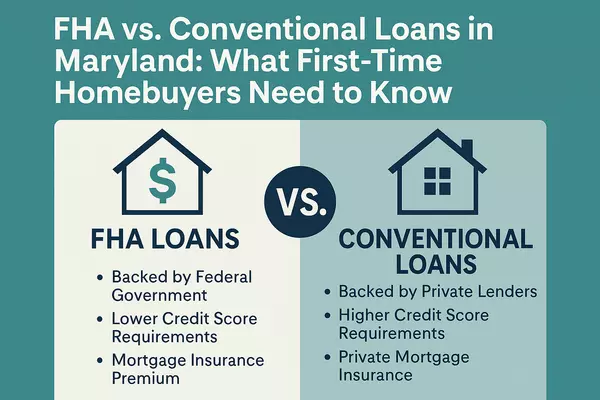

✅ What loan programs (like FHA or conventional) you can access

A higher credit score can save you thousands of dollars over the life of your loan. So, it’s worth taking time to strengthen it before you apply.

💳 Step 1: Check Your Credit Report

Request a free copy of your credit report at AnnualCreditReport.com. Review it carefully and look for:

-

Errors or inaccuracies

-

Old accounts that should be closed

-

Unauthorized activity

Dispute anything that looks wrong, as fixing errors can quickly boost your score.

💰 Step 2: Pay Down Your Debt

Your credit utilization ratio (how much of your available credit you’re using) makes up about 30% of your score.

-

Try to use less than 30% of your credit limit on any card.

-

Pay off balances strategically, focusing on high-interest cards first.

-

Avoid maxing out your cards, even if you plan to pay them off monthly.

⏱ Step 3: Pay Bills On Time—Every Time

Your payment history is the biggest factor (about 35%) in your credit score.

-

Set up automatic payments or reminders.

-

Catch up on any missed payments.

-

Stay current on all accounts, even small ones like medical bills or store cards.

🏦 Step 4: Avoid Opening or Closing Accounts

It might be tempting to open a new credit card or close an old one, but:

-

Avoid new credit inquiries before applying for a mortgage.

-

Keep older accounts open to benefit from their long credit history.

-

Don’t take out car loans or other large debts in the months leading up to your mortgage application.

🛠 Step 5: Work With a Mortgage Expert

Sometimes it’s worth getting professional advice. A mortgage lender can:

-

Help you estimate how much home you can afford.

-

Recommend loan programs that fit your current score.

-

Suggest additional strategies to strengthen your application.

💬 Final Thoughts

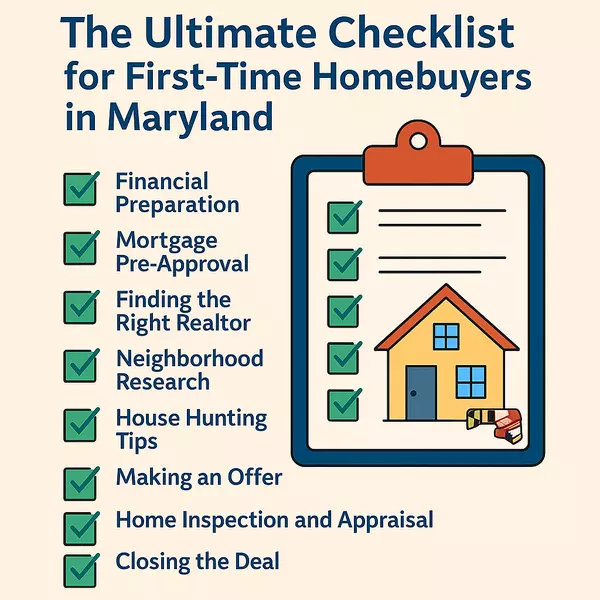

Improving your credit score doesn’t happen overnight, but even small steps can make a big difference. Whether you’re buying in Prince George’s County, Montgomery County, or anywhere in Maryland, I’m here to guide you through the homebuying process.

If you want a list of trusted local lenders or a personalized plan to get mortgage-ready, reach out today!

Luis Villatoro

Realtor® | Home Nexus Group

📍 Serving Maryland

📞 301-892-1474

📧 LV@homenexusgroup.com

📱 Instagram: [@realtor.villatoro]

Categories

Recent Posts