Credit Essentials: How Good Credit Can Impact Your Home-Buying Journey

In the journey to homeownership, credit plays a crucial role. Whether you’re a first-time homebuyer or planning to make a move, understanding how credit works, how to build it, and how to repair it can significantly affect the buying process. Here, we’ll dive into what it means to have good credit, why it’s important, and ways to improve or rebuild credit if needed.

What Is Credit and Why Does It Matter?

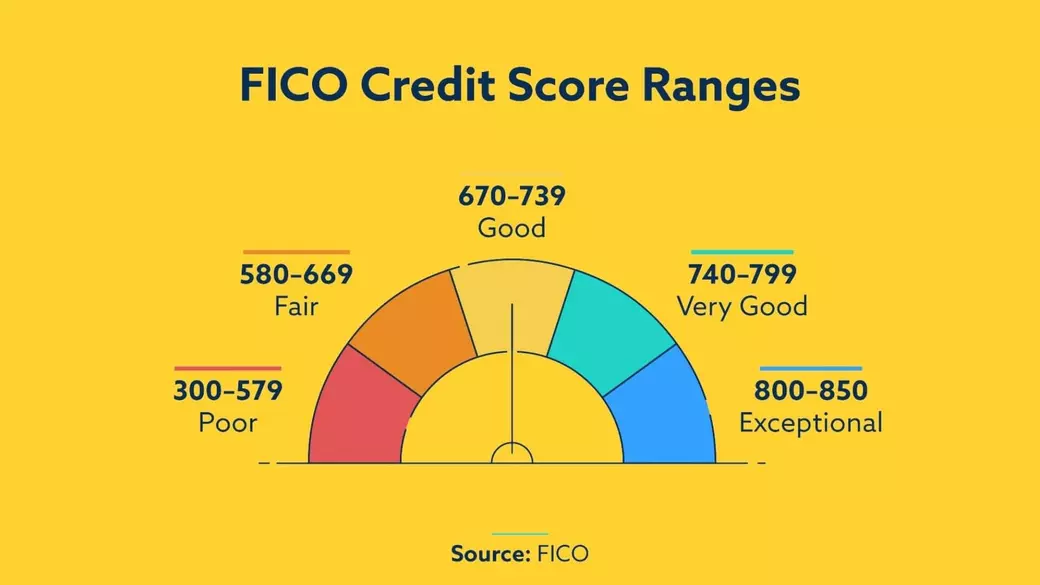

Credit refers to the ability to borrow money with the understanding that it will be paid back over time. A good credit score reflects that you’re likely to repay loans as agreed, which makes lenders more willing to approve loans at favorable interest rates. Scores generally range from 300 to 850, with scores over 700 considered good and those over 800 excellent. In the home-buying process, having a good credit score can be a game-changer.

How Good Credit Can Help You as a Homebuyer

- Lower Interest Rates

A higher credit score often leads to better loan terms. This means you could qualify for lower interest rates, which will reduce your monthly mortgage payments and save you thousands over the life of the loan. - Higher Approval Chances

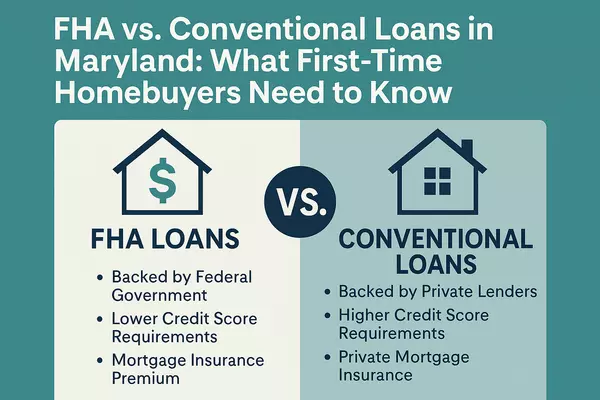

Lenders look at credit scores to gauge risk. A strong score shows that you’re a reliable borrower, increasing the likelihood of mortgage approval. - Access to Better Loan Options

With good credit, you may qualify for different loan programs, such as conventional loans with lower down payments or government-backed loans like FHA or VA loans, which can come with additional benefits for eligible buyers.

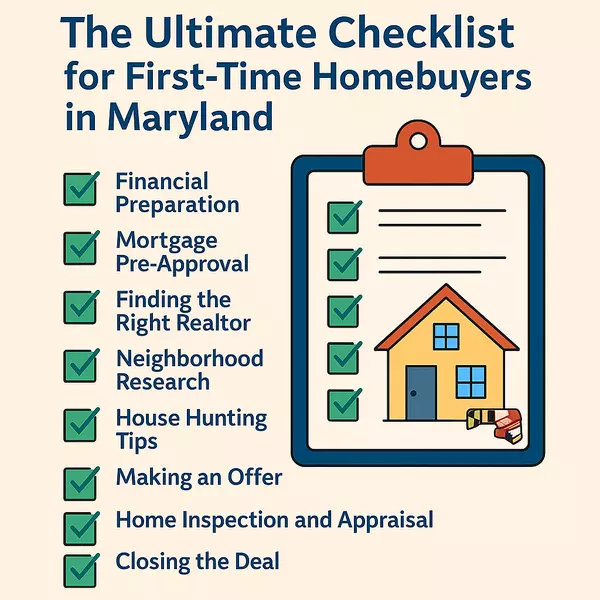

Building and Repairing Your Credit: Tips and Strategies

If you’re working to improve your credit, whether you’re starting from scratch or rebuilding after past issues, here are key steps to help:

- Check Your Credit Report

Start by requesting a free copy of your credit report from all three major bureaus (Experian, TransUnion, Equifax) at AnnualCreditReport.com. Review it for accuracy and dispute any errors you find. Incorrect entries can hurt your score, so it’s essential to keep your report accurate. - Pay Bills on Time

Payment history is the largest factor affecting your credit score. Make sure to pay all bills on time, including credit card bills, utility payments, and loan installments. Setting up automatic payments or reminders can help you stay on track. - Reduce Credit Card Balances

Your credit utilization ratio – the amount of credit you’re using compared to your total available credit – also affects your score. Aim to keep your balance below 30% of your limit on each card, and ideally, below 10% for an extra boost. - Limit New Credit Applications

Each time you apply for credit, a hard inquiry is added to your credit report, which can temporarily lower your score. Avoid opening too many new accounts at once, as this can signal financial instability. - Become an Authorized User

If you have a trusted family member or partner with good credit, ask if you can become an authorized user on their account. Their positive credit history can help improve your score, provided they maintain responsible payment habits. - Consider a Secured Credit Card or Credit Builder Loan

For those building or rebuilding credit, secured credit cards or credit builder loans can be great tools. With a secured card, you make a deposit that acts as your credit limit, making it lower risk for lenders and helping you establish a positive payment history. Credit builder loans work similarly, where monthly payments contribute to your score and help you build credit responsibly.

Keeping Your Credit Strong for Home Buying and Beyond

Maintaining a strong credit profile isn’t just important for getting approved for a mortgage; it’s also helpful for your long-term financial health. Good credit can provide lower costs on car loans, personal loans, insurance, and sometimes even utility or rental services.

If you’re in the process of buying a home or looking to do so in the near future, take steps now to optimize your credit. The better your score, the smoother your buying process will be—and the more options and savings you’ll have as you move toward your goal of homeownership.

Categories

Recent Posts