Interest rates

Navigating the real estate market can be a daunting task, especially when interest rates are on the move. For prospective buyers, understanding how these rates affect their purchasing power is crucial. With recent fluctuations in interest rates, now is an excellent time to delve into what this means for you.

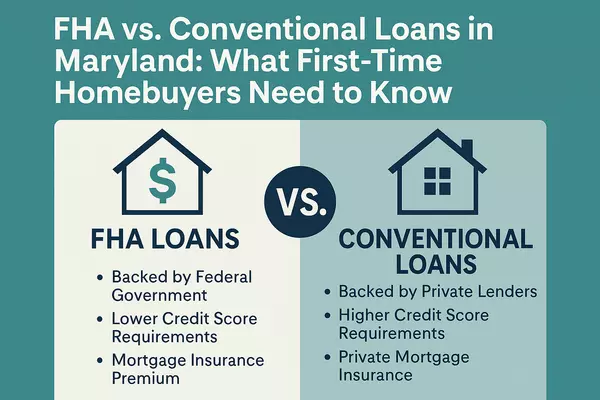

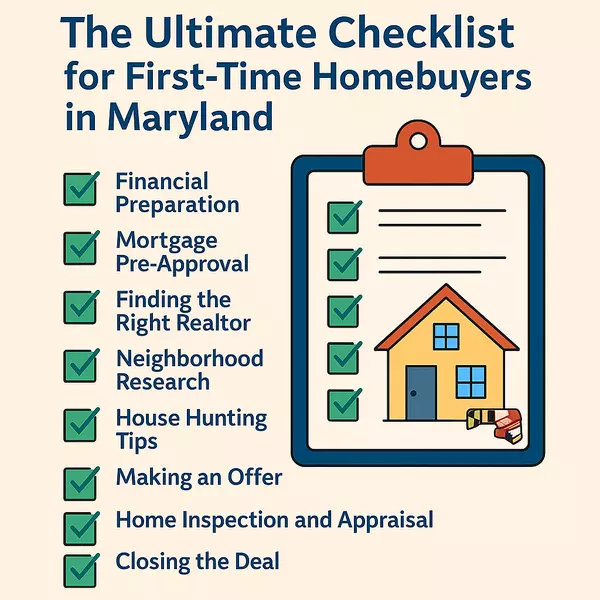

Firstly, let’s talk about buyers. When interest rates are low, it’s typically a favorable time to secure a mortgage. Lower rates mean lower monthly payments, which can make homeownership more accessible. Conversely, rising interest rates can increase the cost of borrowing, potentially putting some properties out of reach for budget-conscious buyers. It’s essential to keep an eye on rate trends and consult with financial advisors to lock in the best possible rate.

The current market update indicates a mixed bag for both buyers and sellers. While some regions are experiencing a cooling off period with slower price growth, others remain hotbeds of activity. The Federal Reserve's policies and economic indicators like inflation and employment rates play significant roles in shaping these trends. Buyers should remain vigilant and adaptable, ready to pounce on opportunities as they arise.

Interest rates also impact the broader real estate market beyond individual buyers. They influence everything from housing inventory levels to the types of loans that lenders offer. A rise in interest rates might lead to fewer homes being built or listed, as sellers anticipate reduced demand. On the flip side, stable or declining rates can spur construction and listings, creating more options for buyers.

In conclusion, staying informed about interest rate trends is vital for anyone involved in real estate. Whether you're a first-time homebuyer or a seasoned investor, understanding how these rates affect your financial landscape will help you make smarter decisions. Keep an eye on economic reports and consult with experts to navigate this ever-changing market effectively.

Categories

Recent Posts