First-time homebuyer guide

Purchasing your first home is an exhilarating milestone, but it can also feel overwhelming with the myriad of decisions and steps involved. This guide aims to demystify the process, offering practical advice on financial planning, exploring mortgage options, and a step-by-step approach to buying your first home.

### Financial Planning

Before diving into house hunting, it's essential to get your finances in order. Start by evaluating your current financial situation:

1. **Budgeting:** Create a detailed budget that includes all sources of income and expenses. This will help you determine how much you can afford to spend on a home.

2. **Savings:** Aim to save for a down payment, which typically ranges from 3% to 20% of the home's purchase price. Additionally, set aside funds for closing costs, moving expenses, and an emergency fund.

3. **Credit Score:** Your credit score plays a significant role in securing a mortgage with favorable terms. Check your credit report for errors and work on improving your score by paying down debt and making timely payments.

4. **Debt-to-Income Ratio (DTI):** Lenders use this ratio to assess your ability to manage monthly payments and repay debts. Aim for a DTI below 36%, including your future mortgage payment.

### Mortgage Options

Understanding the various mortgage options available can help you choose the best fit for your financial situation:

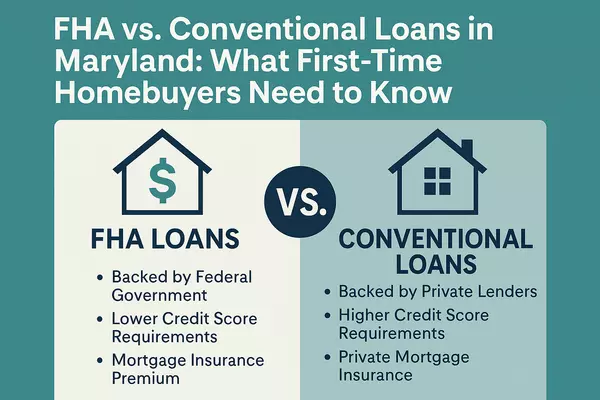

1. **Conventional Loans:** These are not insured by the federal government and typically require a higher credit score and down payment. They offer competitive interest rates and flexible terms.

2. **FHA Loans:** Insured by the Federal Housing Administration, these loans are popular among first-time buyers due to lower credit score requirements and down payments as low as 3.5%.

3. **VA Loans:** Available to veterans and active-duty service members, VA loans offer no down payment options and competitive interest rates.

4. **USDA Loans:** Designed for rural homebuyers with low-to-moderate incomes, USDA loans offer no down payment options and reduced mortgage insurance costs.

### Step-by-Step Guide

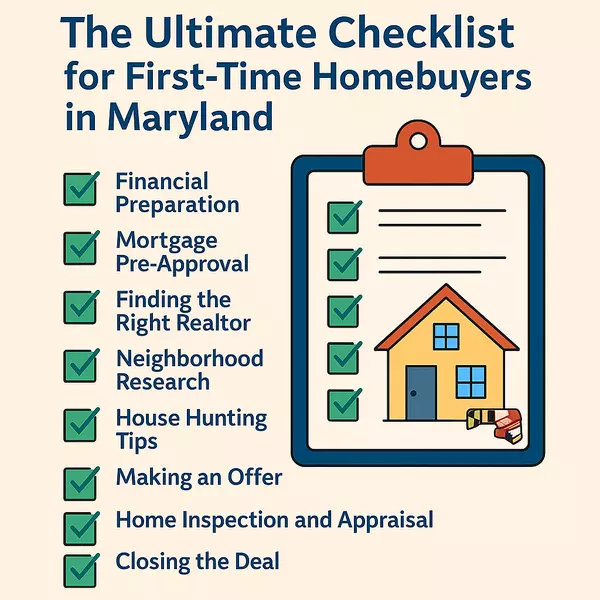

Navigating the homebuying process is easier with a clear roadmap:

1. **Pre-Approval:** Before you start looking at homes, get pre-approved for a mortgage. This shows sellers you're serious and helps you understand how much you can borrow.

2. **Find a Real Estate Agent:** A knowledgeable agent can guide you through the process, provide valuable market insights, and negotiate on your behalf.

3. **House Hunting:** Make a list of must-haves and nice-to-haves in a home. Visit open houses and schedule showings with your agent.

4. **Make an Offer:** Once you find the right home, work with your agent to make a competitive offer based on market conditions and comparable sales.

5. **Home Inspection:** After your offer is accepted, hire a professional inspector to check for any issues that might need addressing before closing.

6. **Appraisal:** Your lender will order an appraisal to ensure the home's value matches the loan amount.

7. **Closing:** Review all closing documents carefully before signing. Pay attention to loan terms, interest rates, and closing costs.

8. **Move In:** Once everything is finalized, receive the keys to your new home! Celebrate this significant achievement but also remember to update your address with relevant institutions.

Buying your first home is both exciting and complex, but with careful planning and informed decisions, it can be a smooth journey toward achieving one of life's most rewarding milestones—homeownership!

Categories

Recent Posts